16 Years of Expertise. >$150 Million Recovered for Small Businesses. 6,000+ Happy Clients.

Attention: Manufacturing Company Owners

Get Your R&D Refund Checks

Over 75% of our manufacturing clients qualify and recover on average $65,000 in overpaid taxes.

Start Recovering Your Company's Refund

Important Distinction: R&D Credits are separate from Employee Retention Tax Credits (ERTC). We also recover ERTC, but this survey establishes if you qualify for R&D credits.

Claiming R&D Credits is a Retroactive Recovery

Qualified manufacturing companies receive multiple checks (up to three federal and three state checks).

Years processed: 2017, 2018, 2019

Location: Dublin, CA

Employees: 18

Entity type: S Corp

Activities:

- A stand-alone facility fully equipped to meet the needs for contract wholesale screen printing and embroidery services

Refund Recovery: $130,936

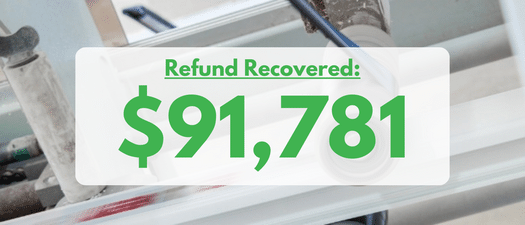

Years processed: 2017, 2018, 2019

Location: Placentia, CA

Employees: 30

Entity type: C Corp

Activities:

- Distributor of provider of pre-press, press and finishing equipment

- Specializing in pre-owned printing equipment, parts, and supplies

Refund Recovery: $91,781

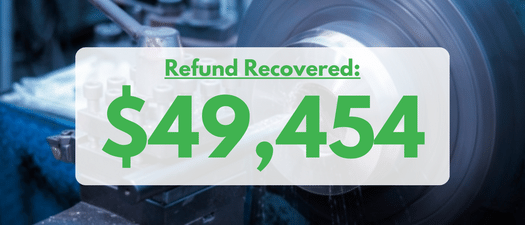

Years processed: 2017, 2018, 2019

Location: Morgan Hill, CA

Employees: 10

Entity type: S Corp

Activities:

- Design and prototype development

- Fabricate and manufacture machining parts

- CNC machining

- CNC turning

Refund Recovery: $49,454

Years processed: 2017, 2018

Location: Encinitas, CA

Employees: 6

Entity type: S Corp

Activities:

- Design, fabricate and manufacture metal and plastic promotional products for advertising

Refund Recovery: $52,142

Years processed: 2017, 2018, 2019

Location: Loomis, CA

Employees: 44

Entity type: S Corp

Activities:

- In House design

- Fabricate and manufacturer of off-road vehicle parts, tools, and accessories

Refund Recovery: $137,132

Years processed: 2017, 2018, 2019

Location: North Hollywood, CA

Employees: 14

Entity type: S Corp

Activities:

- Design, fabrication, manufacturing, and installation of textiles and hardware for award shows and large events

Refund Recovery: $24,599

Don't Miss This Major Tax Break

R&D Credits for Small Business Owners in the News

Source:https://www.forbes.com/sites/deanzerbe/2013/03/28/eight-myths-that-keep-small-businesses-

from-claiming-the-rd-tax-credit/?sh=4cd3511c2944

Source: https://www.inc.com/john-hewitt/two-tax-

credits-many-small-businesses-miss.html

What Our Clients Say

The R&D Program Explained

Established nearly 40 years ago, the R&D Credit Program is a largely unknown and often underutilized opportunity by small and medium-sized manufacturing businesses to lower their tax burden and enhance their financial strength.

The R&D Credit Program - originally established in 1981 and made permanent with the Protecting Americans From Tax Hikes (PATH) Act of 2015 - is a little-known opportunity to give manufacturing businesses substantial tax savings and strengthen their financial health, in addition to developing innovative new ways to build.

Unlike other industries, manufacturing businesses do not claim anywhere near the credits and incentives they are entitled to. The main reason is due to self-censoring and lack of time or resources; they don’t feel like they meet the qualifications; they think their CPA already handles it for them, or they are simply too busy running their businesses. These limitations cost manufacturing businesses millions of dollars annually in the U.S.

Our mission is to partner with manufacturing businesses and their accounting/CPA teams across the United States and help them to recover their money with our proven, no-risk, no-strings-attached, speedy process. We have 16+ years specializing in R&D Credits and have recovered over $150,000,000 for 6,000+ happy customers.

It's your money, why not get it back now for up to three years retroactively and then for any years moving forward?

FAQs About R&D Credits

This sounds too good to be true, doesn't it?

No. U.S. companies have been taking advantage of these credits for decades. With the recent changes (PATH ACT in 2015), more small to medium-sized businesses are starting to claim these credits. But even with the increase in claims, less than 5% of companies that qualify for the R&D Tax Credit are taking the time to do so. For dental practices, this number is even smaller: only 2% take advantage of this program although we’ve found that 98% qualify.

Is this worth my time?

Absolutely. Since the changes in legislation and tax reform, the R&D Tax Credit remains one of the most valuable incentives offered by the U.S. government for businesses to remain competitive.

Why does the government offer the R&D Tax Credit?

To encourage companies within the U.S. to keep technical talent domestic while simultaneously continuing to drive innovation. This helps make your company competitive domestically and our country competitive globally. A win-win scenario for everyone.

I have a CPA, why haven’t I heard of this?

It’s a very specific and niche credit CPAs are typically not trained on. More than $16 billion in federal tax credit benefits alone are given out annually, and a tiny percentage is recovered each year, and CPAs do almost none of it. It’s very time-consuming, takes years of training, and is typically not something they are even familiar with.

Can the R&D credit be claimed for a prior year?

Yes, if the amended return is filed within three years of the original filing date.

What expenses qualify for the R&D Credit?

Qualified research expenses include employee wages, material expenses, and contracted labor costs.